I’ve held onto shares of both NXEN and OWCP dating back a couple of years now. Yes, I still believe in a longer term outcome of success for both. Though, as I’ve said in the last few blog posts — I will gladly sell shares if a crazy run were to occur before ‘the final product’ days.

NXEN still has a sweet share structure with 53,984,004 outstanding shares and a confirmed float of 9,877,035 as of June 15th, 2020 — according to Amy at Standard Registrar & Transfer Company.

The last 10-Q on May 14th, 2020, the company said:

While management continues its efforts to raise capital for the Company, it is also seeking merger or other business combination or restructuring opportunities.

While Mr. Greenberg, the Interim CEO, and company apparently seek additional capital or a potential partnership/merger, I wondered what else could be going on.

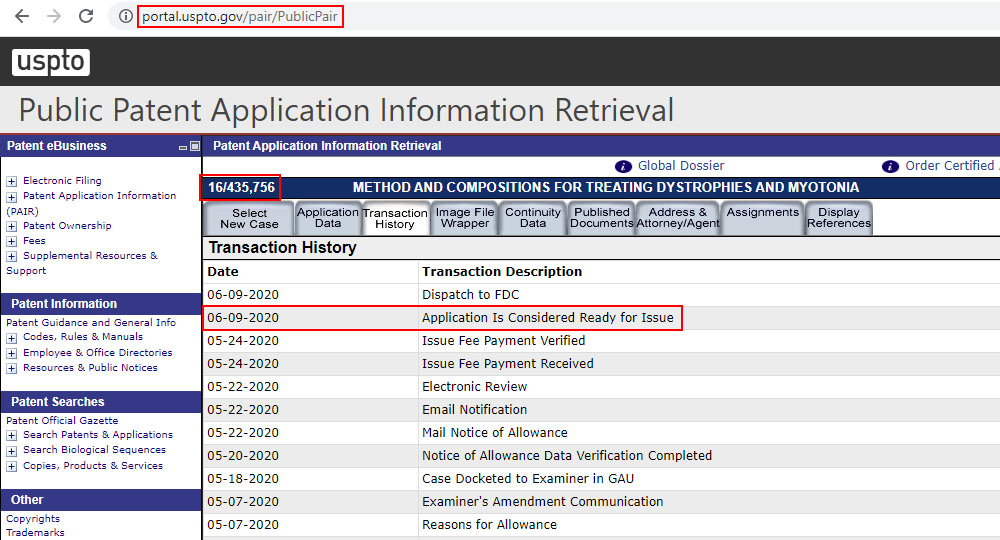

Seeing as though their last announcement had to do with a Patent in Israel, I decided to dig in and see if there’s been other Intellectual Property progress over at the USPTO ‘Public PAIR’ website.

Sure enough, I was able to locate Application Number 16/435,756 and noticed it says, “Application Is Considered Ready for Issue” as of 6/09/2020 after the USPTO received payment on 5/24/2020.

So, it’s safe to assume NXEN will have some kind of PR out in the coming days or weeks about that. But, is it enough to get some volume flowin’ through this Low Float stock? Your guess is as good as mine. OWCP sure had a fire lit from under its ass after their Patent Issuance news back on December 16th, 2019 and they managed to run from a low of $0.0066 to a peak of $0.1533 on January 3rd, 2020 for an increase of 2,222.7%.

Every stock is different. NXEN certainly hasn’t had the attention OWCP has had, but again, NXEN at least has a 9.8M float compared to OWCP’s 206.5M (as of February 2020).

Let the record state: If NXEN runs to $3.00+ any time soon (without substantial news) — I’m selling!

Though, I will watch for a re-entry point and continue to hold for the hopeful FDA Approved news ‘some day’.

53,984,000 shares at $3.00 per share is “only” a $161.4M market cap.

When OWCP ran to $3.23 on February 23rd, 2017, it had 144,719,287 outstanding shares (according to the 10-K for year ending 2016). That was (briefly) a Market Cap of $467,443,297.

So, in other words, $8.65 per share is “possible” purely based on complete insanity that I witnessed firsthand on February 23rd, 2017 — but in no way am I suggesting you should buy and wait for $3, $6, or $8 per share. Hell, I’m not even saying you should buy NXEN. (See disclaimer below.)

But, keep in mind… NXEN previously told us about a Pre-IND meeting with the FDA and about an Ivy League Medical School partner. I suspect if they’re able to secure additional investment capital, we could hear some sweet updates. Tell me an FDA Approved Study wouldn’t create some OTC buzz. 😉

Disclaimer: Always, always, always do your own due diligence and never take somebody else’s word for it. It’s your money. Follow the links, read the filings, and decide for yourself if you want to invest or trade a particular stock.

I have never been compensated in any way, shape, or form for writing blogs for this company or any other company for that matter. (Even my attempt to earn revenue from Google AdWords has been a joke. Haha.)